Dynamic Systems Inc. (DS) received an order to manufacture a customized airplane for the official use of the president of Pakistan. DS will charge an amount equal to the cost of the airplane plus a 30% profit margin on cost to the government of Pakistan. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Create a free account to unlock this Template

In addition to specific price and cost, these are other important considerations. A liability is a present obligation for an organization to provide cash or some other service in the future. Examples of common liability accounts include, Accounts Payable, Salaries Payable, or Taxes Payable. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

- Assets are items that an organization owns that have future value to the organization.

- Consulting, law,and public accounting firms use job costing to measure the costs ofserving each client.

- The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales.

- The credit for raw materials costs is typically recorded in the Cash account or a related liability account.

Problem 2: Charging Actual FOH to Jobs

The new transactions will be marked as NEW and a brief explanation and/or calculation will follow each. The processes to solve the following scenario are demonstrated in Video Illustration 2-2 below. On January 1, Cincy Chips estimates that they will produce 50,500 microchips and run 2,080 machine hours in the upcoming year. The cost formula to estimate manufacturing overhead at the beginning of the year is $128,960 fixed plus $33 variable overhead per machine hour.

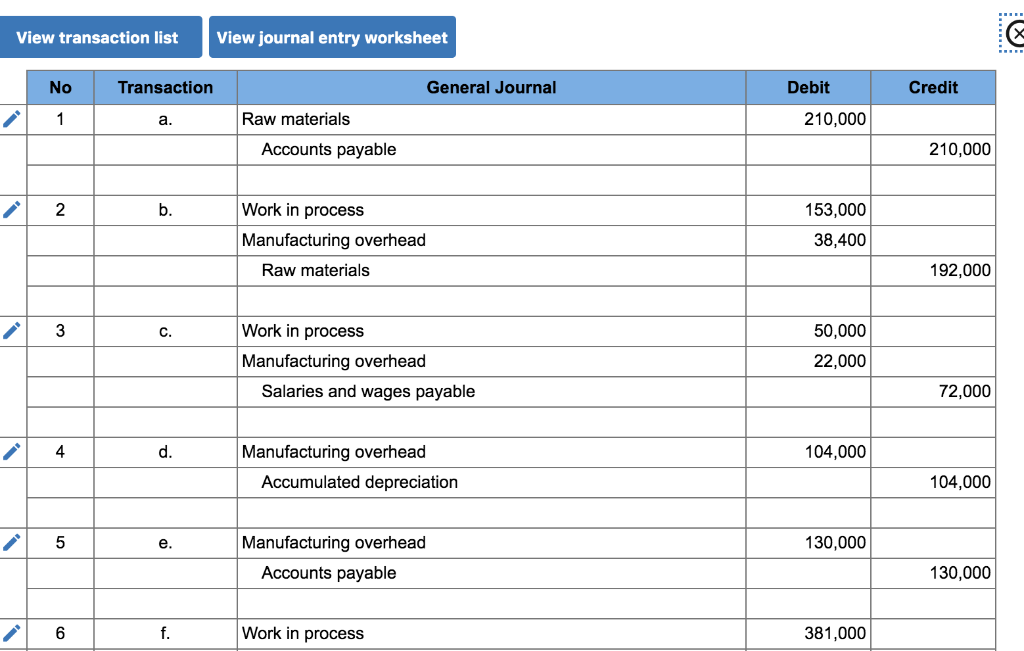

4: Job Costing Process with Journal Entries

Overhead is assignedto a job at the rate of $ 2 per machine-hour used on the job. Job16 had 875 machine-hours so we would charge overhead of $1,750 (850machine-hours x $2 per machine-hour). Job 17 had 4,050machine-hours so overhead would be $8,100 (4,050 machine-hours x$2). The journal entry to apply or assign overhead to the jobswould be to move the cost FROM overhead TO work in processinventory. Indirect labor records are also maintained through time tickets, although such work is not directly traceable to a specific job. The difference between direct labor and indirect labor is that the indirect labor records the debit to manufacturing overhead while the credit is to factory wages payable.

Video Illustration 2-2: Computing an organization-wide predetermined manufacturing overhead rate LO3

Direct materials are raw materials costs that can be easily and economically traced to the production of the product. The estimated manufacturing overhead value can be compared to the actual manufacturing overhead value in a separate manufacturing T-account to determine any significant differences. Our post on job order costing bookkeeping journals provides further details of the accounting entries referred to above. The purpose of the job costing system is to accumulate the costs relating to a particular job.

Assets are items that an organization owns that have future value to the organization. The inventory accounts commonly used in a job-order costing system include the Raw Materials account, Manufacturing Overhead account, Work in Process account, and Finished Goods account. Product costs, or manufacturing costs, flow through these accounts until the product what is the turbotax phone number is complete. The total cost to manufacture the finished product is held in the Finish Goods inventory account until the product is sold. XYZ Company estimates that for the current year, it will work 75,000 machine hours and incur $450,000 in manufacturing overhead costs. The company applies overhead cost on the basis of machine hours worked.

Factory Overhead is used to record only factory expenses, but not selling or administrative costs. Under this system, costs are assigned to jobs based on the number of direct labor hours required to manufacture each job. Costs are accumulated for each different job during the production process. Material and labor costs that cannot be traced directly to the product produced are included in the overhead costs that are allocated in the production costing process.

Here is avideo discussion of job cost journal entries and then we will do anexample. In contrast, period costs are not directly related to the production process and are expensed during the period in which they are incurred. This approach matches administrative and other expenses shown on the income statement in the same period in which the company earns income. Raw materials are stored in the materials storeroom and delivered to the appropriate production department—cutting, painting, or assembly/finishing. The design department uses direct labor to create the design specifications, and, when completed, it sends them to the production department. The production department uses the material and design specifications and adds additional labor to create the sign.

Comprehensive Problem LO3-1, LO3-2, LO3-4Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China market. The company sells its birdcages through an extensive network of street vendors who receive commissions on their sales. Sales revenue is the income received by a company from its sales of goods or the provision of services. Homework questions can be used for additional practice or can be assigned in an academic setting.

Homework questions can be assigned, with auto-grading and export, to specific learning management platforms, e.g., Canvas, Blackboard, etc. The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Access and download collection of free Templates to help power your productivity and performance.